Online Loans Made Easy: Your Ultimate Option for Urgent Money Needs

On the internet finances have emerged as a viable option for individuals encountering immediate cash money requirements, using a streamlined process that assures performance and availability. The benefits and prospective risks of on the internet loans create a compelling landscape that necessitates expedition for any individual seeking monetary assistance in times of urgency.

Advantages of Online Loans

On-line financings use a convenient and efficient way for people to access monetary aid without the requirement for traditional in-person interactions. One of the key advantages of on-line financings is the rate at which they can be processed. Unlike conventional financings that may take weeks to approve, on-line finances usually give immediate decisions, allowing debtors to resolve their economic requirements promptly. This quick turn-around time can be particularly helpful in emergency circumstances where immediate access to funds is important.

One more advantage of on-line car loans is the ease of application. Consumers can finish financing applications from the comfort of their very own homes, eliminating the requirement to go to a physical bank or economic establishment.

Eligibility and Application Process

Fast Approval and Disbursement

Efficient authorization procedures and rapid disbursement of funds are key functions of online lendings that cater to the prompt economic needs of consumers. Unlike typical financial institution fundings that might take weeks to process, on-line lenders make websites use of sophisticated technology to streamline the approval procedure.

Contrast With Standard Financing

As opposed to the streamlined approval procedures and rapid fund disbursement seen in on the internet lendings, conventional borrowing techniques typically entail extra prolonged application processing times and financing hold-ups. When obtaining a finance with conventional ways, such as banks or credit report unions, consumers often deal with a tiresome process that includes filling in substantial documents, offering security, and undertaking detailed credit checks. This can result in days or also weeks of awaiting authorization and ultimate disbursement of funds, which may not be perfect for individuals in immediate requirement of cash money.

In addition, typical loan providers tend to have more stringent eligibility criteria, making it challenging for people with less-than-perfect credit rating or those lacking substantial possessions to secure a finance - personal loans calgary. On the various other hand, on the internet loan providers, leveraging modern technology and different data resources, have actually made it feasible for a bigger array of borrowers to access fast and convenient financing remedies. By simplifying the application process and quickening authorization times, online financings supply a hassle-free choice to typical this website loaning for those seeking immediate financial aid

Tips for Accountable Borrowing

When considering obtaining cash, it is from this source vital to approach the procedure with careful consideration and economic mindfulness. Here are some tips to make certain responsible loaning:

Assess Your Demand: Prior to getting a funding, evaluate whether it is a necessity or a want. Stay clear of borrowing for non-essential expenses.

Borrow Only What You Can Settle: Determine your repayment ability based upon your income and costs. Borrow just an amount that you can conveniently pay off without stressing your finances.

Understand the Terms: Check out and understand the terms of the lending agreement, including rate of interest, fees, and settlement routine (alberta loans). Clarify any kind of questions with the loan provider before proceeding

Compare Lenders: Research and contrast offers from different loan providers to find the most positive terms. Look for reputable lending institutions with transparent practices.

Avoid Numerous Finances: Avoid taking multiple financings simultaneously as it can cause a financial debt spiral. Prioritize repaying existing debts prior to thinking about new ones.

Final Thought

To conclude, on-line car loans supply a convenient and quick remedy for immediate cash requirements. By giving very easy accessibility to funds, streamlined application processes, and quick approval and dispensation, on the internet lendings can be a trusted choice for those facing monetary emergencies. However, it is necessary for borrowers to work out liable loaning methods to prevent dropping into financial obligation traps and financial difficulties in the future.

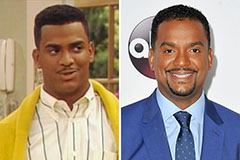

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Robert Downey Jr. Then & Now!

Robert Downey Jr. Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now!